Green Park Partners (“GPP”) announces the acquisition of Kongskilde Industries A/S from DLG Group in Denmark.

The Company

- Founded in 1949 and headquartered in Denmark.

- Kongskilde Industries A/S (« Kongskilde ») develops, manufactures and markets pneumatic transport systems and equipment for the separation and purification of waste and process materials for companies primarily in the plastics and paper industry; as well as systems for the transport, purification and drying of grain and other crops. Kongskilde’s sales are through dealers and own sales companies in Europe, North America, Asia and Africa.

- Kongskilde’s industrial solutions contribute to the automation and efficiency of customer’s production, recycling of process waste and improvement of the working environment. Kongskilde’s solutions are modular, simple to install in existing production buildings and require minimal maintenance.

- Kongskilde’s solutions in grain are high quality, flexible applications and with capacity adapted to small and medium-sized farms. Kongskilde’s long-standing experience in the agricultural sector ensures a high service level and good availability of spare parts.

- Kongskilde is a market leading provider in its respective segments with revenues of DKK 247m (Euro 33m) and more than 200 employees located in Denmark and in 9 offices in Europe, USA, Asia and South Africa.

- kongskilde-industries.com

Why did GPP Acquire Kongskilde

- Kongskilde is a profitable market leader with significant potential for further growth and development.

- Attractive Market:

- Kongskilde’s market in plastic and cardboard packaging is growing steadily. At the same time, Kongskilde is developing existing and new customer segments that increasingly recognise the benefits and advantages of Kongskilde’s pneumatic transport and purification systems.

- Kongskilde also has a strong brand and customer loyalty in the agricultural sector with significant opportunities for further strengthening market distribution.

- Kongskilde is recognized as a reliable and competent business partner.

- Kongskilde has a large and loyal client base which Kongskilde has served for many years and which represents a large proportion of Kongskilde’s revenues.

- Experienced Management Team & Strong Competencies

- Kongskilde has an experienced and competent management team with strong market and technical competencies and which has succeeded in developing the business significantly in recent years.

- The company has good market coverage with 9 sales offices in Europe, North America, Asia and South Africa.

- The company is recognized for its know-how and its many high quality industry-specific solutions, and Kongskilde has an extensive base of customer installations especially in Europe and North America.

- Product Portfolio

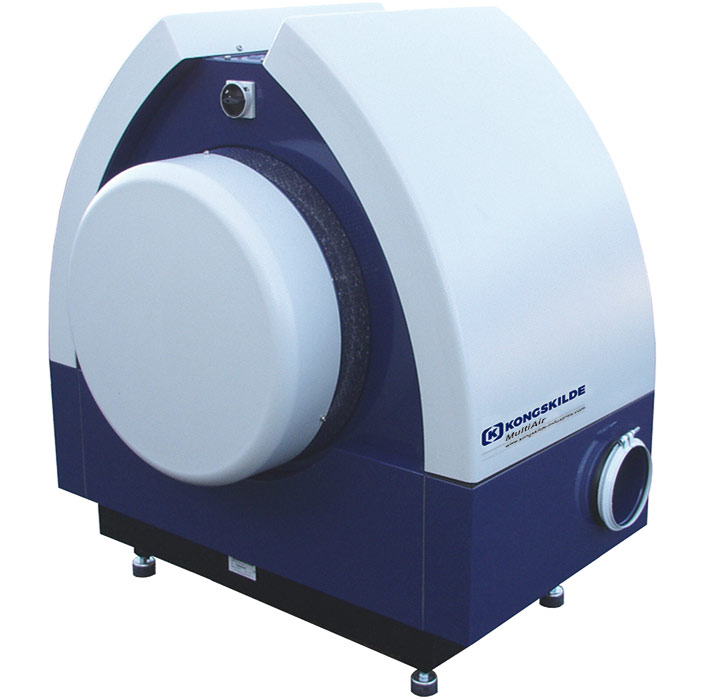

- Kongskilde has a broad portfolio of proven system solutions for industrial companies and has recently cemented the Company’s innovation and technical leadership through the launch of the MultiAir3 blowers, RVS-H multi-separator and CVL separator.

- Kongskilde’s product range within grain transportation and sorting is of a high quality and has been continuously improved and developed for 70 years.

Comments from GPP Team

- GPP identified Kongskilde as a non-core business of the DLG Group and believe the Company will benefit from the support and focus provided by a committed and motivated new owner.

- Hiten Shah, partner at GPP, said: “Kongskilde is a market leader with excellent potential for further growth. This acquisition demonstrates GPP’s ability to source, structure and execute complex corporate carve-outs of SME businesses in Europe and our entrepreneurial and pragmatic approach to transactions”.

- Morten Bligaard, managing partner at GPP, said: “We would like to thank the DLG Group for a professional and smooth process. We are very excited about the journey ahead and look forward to being a constructive and positive partner to Kongskilde, its employees and its management”.

About Green Park Partners

- GPP is a UK based Principal Investment firm. GPP proactively seek out, un-lock and create transaction opportunities by acquiring businesses that can benefit from re-vitalisation through strategic and operational initiatives, a modified business model and the support of new ownership.

- GPP’s target profile is European headquartered businesses with revenues between €20m and €200m. Situations GPP target in particular include corporate spin-offs / carve-outs and platform investments with the potential for a buy-&-build strategy and further internationalisation.

- GPP partner with family offices and high net worth individuals that are seeking direct private equity investments.

- greenparkpartners.com

GPP’s Advisors on the Transaction

- Legal Adviser: Accura Advokatpartnerselskab

- Financial Adviser: Grant Thornton Denmark

For further information, please contact:

Morten Bligaard, Managing Partner Tel.: +44 (0)20 7118 1200 Mobile: +44 (0)77 6965 1112

Hiten Shah, Partner Tel.: +44 (0)20 7118 1200 Mobile: +44 (0)78 9425 9719